Contents

- The Foundation for Illiquidity Decisions

- Purpose Before Product

- Fitting Alternatives Into the Total Market Picture

- Protecting Long-Term Lifestyle and Asset Strategy

- Guarding Against New Risks

- Looking Beyond Gross Returns

- Allocating With Confidence

- Aligning Illiquid Assets With Your Legacy

- Monitoring, Educating, and Adjusting

A Somerset CLARITIES Perspective on When—and How—They Truly Add Value

EXECUTIVE SUMMARY

In recent decades, alternative investments have moved from the margins to the mainstream of high-net-worth portfolios. These strategies may offer exposure to opportunities that differ from those available in traditional markets and can serve as potential diversifiers within a broader investment plan.

Yet for every success story, there are quieter tales of disappointing returns, unexpected tax consequences, and liquidity strains. The question is not simply “Should I invest in alternatives?” but rather “Do they fit my plan, my priorities, and my capacity for illiquidity — and if so, how much?”

At Somerset, our CLARITIES process begins with understanding each client’s cash flow and objectives, then moves through a disciplined framework designed to evaluate the role alternatives may play within a diversified portfolio. This

approach helps inform decisions about allocation size, structure, and implementation in a manner consistent with each client’s broader financial plan.

This in-depth analysis integrates decades of empirical research with the CLARITIES approach to show when alternatives deserve a place in your portfolio, and when they may simply add complexity without meaningful benefit.

C – CASH FLOW

The Foundation for Illiquidity Decisions

Every conversation about alternatives begins with liquidity. Long lockups and unpredictable distributions mean your portfolio must function without easy access to committed capital for years.

Because we begin with a deep, precise cash flow analysis, we aim to determine exactly how much illiquidity you can take on without compromising:

- Day-to-day lifestyle spending.

- Known future obligations — tuition, real estate purchases, philanthropic commitments.

- Opportunistic investments you may wish to make along the way.

- Mismatched liquidity is often a common cause of poor alternative outcomes.

Our approach helps clients make more informed, confident decisions about their finances and decisions around alternative investments.

L – LISTENING

Purpose Before Product

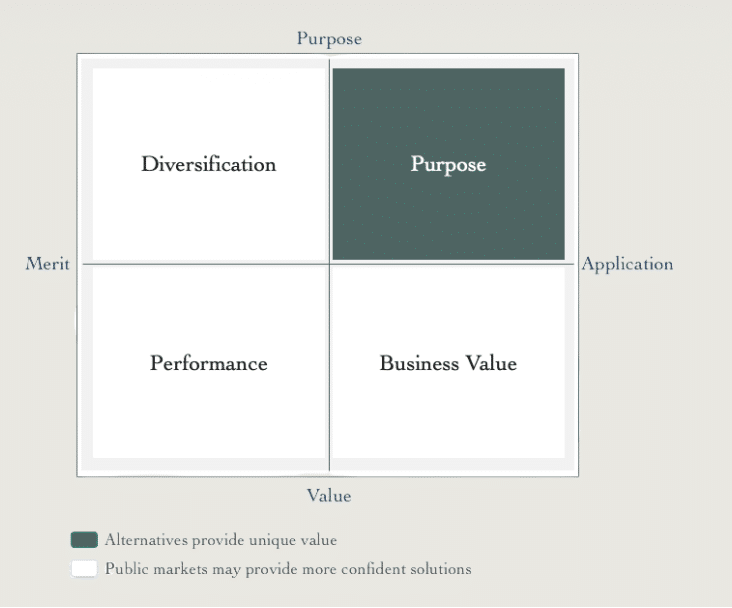

Alternatives should not exist in a vacuum; they should serve a purpose that matters to you. We listen carefully to your goals and values before making any recommendations.

For some, that purpose might be:

- Advancing impact or ESG objectives through targeted private investments.

- Using alternatives as part of a strategic wealth transfer plan.

- Diversifying away from concentrated business or industry exposure.

For others, it may be purely about return enhancement or risk reduction. The “Investor Purpose” framework from the research reminds us that without a clear purpose, alternatives can become distractions — or worse, vanity projects — that add cost without adding value.

A – ASSET ALLOCATION / ALLOTMENT

Fitting Alternatives Into the Total Market Picture

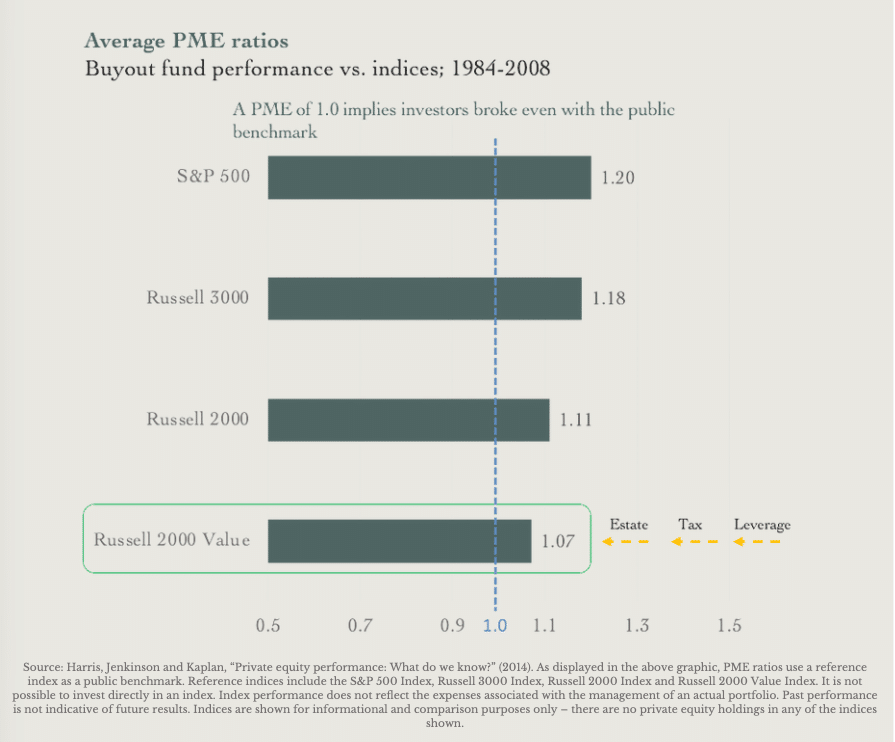

Once purpose and liquidity are clear, we test whether alternatives improve the overall portfolio. This is where the data is sobering:

- Diversification claims can be overstated — private equity’s reported correlation to public equity has climbed from 38% in 2000 to 82% in 2015, largely due to more realistic valuation practices.¹

- Performance persistence is rare — top-quartile managers post-2000

have been no more likely to repeat their success than average managers.² - Public Market Equivalent (PME) analysis shows many alternatives match or underperform a leveraged, risk-adjusted public index after fees and taxes.³

We only include alternatives if they measurably enhance your return-to-risk profile (based on the results from our CLARITIES analysis of your financial life) while preserving the integrity of your broader allocation.

R – RETIREMENT (OR REAL ESTATE IN UHNW)

Protecting Long-Term Lifestyle and Asset Strategy

Alternatives often require staying power. Venture capital and private equity commitments can take a decade or more to return capital. Returns are cyclical, with inevitable stretches of underperformance.

For clients in retirement, our goal is to manage liquidity carefully to help meet lifestyle needs without creating undue pressure to exit alternative positions prematurely.

For UHNW clients with significant real estate portfolios, we account for those holdings as part of your illiquidity budget. Alternatives should complement, not crowd, other long-term assets.

I – Insurance

Guarding Against New Risks

Alternatives can introduce different kinds of risk:

- Operational risk from complex fund structures.

- Concentration risk if investments are tied to a particular sector or geography.

- Leverage risk within certain private strategies.

We review your insurance coverage to help determine if these exposures are addressed, whether through personal liability coverage, key person insurance, or other risk transfer tools, so that portfolio complexity doesn’t increase personal vulnerability.

T – TAXES

Looking Beyond Gross Returns

Taxes are often the silent drag on alternative performance. Unlike public equities, which can defer gains indefinitely or receive a step-up in basis at death, most alternatives realize gains within the fund’s life.

From the research:

- Typical private equity and hedge fund structures combined with taxable distributions can materially reduce net returns.

- Public equivalents can sometimes outperform after-tax, even if pre-tax returns are similar or slightly lower.

We model after-tax outcomes in advance so you know what to expect — no surprises when K-1s arrive.

I – INVESTMENTS

Allocating With Confidence

By the time we reach this stage, we know your cash flow, purpose, allocation fit, and tax position. That means your alternative allocation is not a guess — it’s a precise, informed decision.

The importance of access and selection:

- In venture capital, median funds underperform public benchmarks, while top funds significantly outperform.⁴

- In private equity, much of the historic outperformance came from a valuation gap that has now largely disappeared.⁵

- Hedge funds, once adjusted for database biases, have delivered returns similar to public markets with higher costs and taxes.⁶

We focus on sourcing high-quality opportunities through vetted relationships, striving to understand what risk premium

E – ESTATE PLANNING

Aligning Illiquid Assets With Your Legacy

Alternatives can play a role in estate planning, from gifting strategies that take advantage of valuation discounts to using private assets in dynasty trust structures.

We aim to confirm that capital call schedules, distribution timelines, and liquidity events are coordinated with your estate strategy, so these investments strengthen your legacy rather than complicate it.

S – STEWARDSHIP

Monitoring, Educating, and Adjusting

Stewardship is where we close the loop. We monitor alternative performance against agreed benchmarks, reassess the role of each allocation as markets evolve, and provide ongoing education for you and your family.

The research reminds us that even high-quality alternatives can go through prolonged periods of underperformance. Our role is to help you stay anchored to the original purpose, adjust when warranted, and avoid reactive decisions that undermine long-term outcomes.

CONCLUSION

Alternatives are neither inherently superior nor inherently risky — they are tools. When evaluated and implemented through a disciplined process like CLARITIES, they can potentially add meaningful value while aiming to preserve liquidity, flexibility, and long-term goals.

Our advantage lies in beginning with cash flow. By understanding how much illiquidity you can afford, we can recommend when to add alternatives, how much to commit, and how to integrate them into a personalized total market strategy built to last.

SOURCES

- Ilmanen, A. Private equity in a broader portfolio context. Published September, 11 2018. chrome extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.institutionalmoney.com/content/im/pdf/Solvency/2018/AnttiIlmanenAQR.pdf.

- Ghai, S. Private equity: changing perceptions and new realities. McKinsey & Company. https://www.mckinsey.com/industries/private-capital/our-insights/private-equity-changing-perceptions-and-new-realities.

- Harris, et al. A white paper on private equity data and research. UAI Foundation Consortium. Published December, 2010. https://1library.net/article/review-of-research-on-private-equity-investment-performance.q02ooxgy.

- Kaplan, S. It ain’t broke: the past, present, and future of venture capital. Journal of Applied Corporate Finance. 2010; 22(2). chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.qcconference.com/wp-content/themes/qcciir-v2.5/uploads/2011/ppf/papers/KaplanLerner__JACF.pdf.

- Fletcher, D. Demystifying private equity valuations. Russellinvestments.com. Published 2024. Accessed October 8, 2025. https://russellinvestments.com/content/ri/us/en/insights/russell-research/2024/04/demystifying-private-equity-valuations.html.

- Barth D, Joenvaara J, Kauppila M, Wermers R. The Hedge Fund Industry is Bigger (and has Performed Better) Than You Think. Financialresearch.gov. Published February 25, 2020. Accessed October 8, 2025. https://www.financialresearch.gov/working-papers/2020/02/25/01-the-hedge-fund-industry-is-bigger-and-has-performed-better-than-you-think/.

Indivisible Partners, LLC maintains relationships with independent firms such as Fidelity Investments , Fidelity Charitable, eMoney Advisors, Nitrogen Wealth, Advyzon, BizEquity, DPL Financial Partners, iCapital, UPTIQ, Franklin Templeton, and Capital Group to provide custodial, brokerage, or technology services that support our investment management process. These firms are not affiliated with Indivisible Partners, LLC. The names and trademarks of the firms listed are the property of their respective owners. Their inclusion in this document does not imply an endorsement or affiliation with Indivisible Partners, LLC, unless otherwise noted. As a fiduciary, Indivisible Partners, LLC is committed to acting in our clients’ best interests, regardless of our business relationship.

Lauren Pearson is the founding partner and Managing Director of Somerset Advisory, an independent wealth management firm built to serve the complex needs of multigenerational families, entrepreneurs, and executives.

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson

- Lauren Pearson