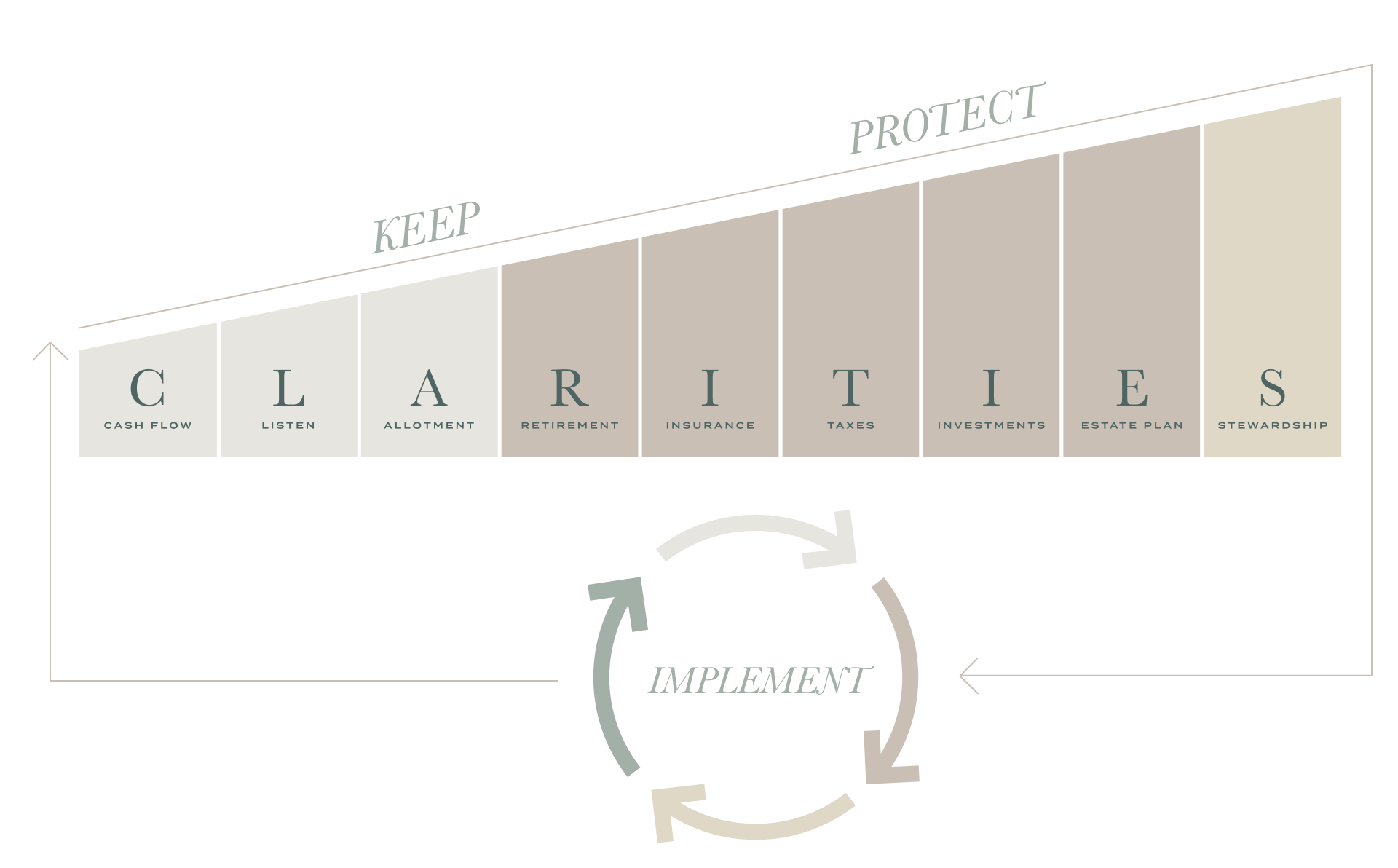

Somerset’s Clarities Process

CLARITIES is Somerset Advisory’s fiduciary planning framework designed to bring structure, sequencing, and clarity to complex financial decisions—integrating cash flow, investments, taxes, estate planning, and long-term stewardship into a disciplined, client-centered process.

PERSONALIZED STRATEGIC WEALTH OVERSIGHT

We start by understanding your financial landscape in its entirety. This isn’t just about managing cash flow—it’s about ensuring that your wealth is aligned with your lifestyle and long-term goals. Together, we assess how your resources can be thoughtfully allocated in support of your financial goals and aspirations, family priorities and long-term wellbeing.

KEEP

We begin by understanding your CASH FLOW and LISTENING to your personal and financial aspirations. Together, we carefully plan your asset ALLOTMENT to ensure your wealth is structured for both security and growth. Our RETIREMENT strategies are tailored to your unique vision for the future, and we ensure your INSURANCE coverage aligns with your lifestyle and goals.

PROTECT

We conduct a comprehensive TAX review to optimize your financial strategies. Your INVESTMENTS are aligned with your long-term objectives, focusing on sustainability and growth. Our ESTATE PLANNING services ensure your legacy is passed on according to your wishes, while STEWARDSHIP guides the responsible management of your resources, including philanthropic endeavors.

IMPLEMENT

Life is dynamic, and so are your financial goals. We continually adapt the CLARITIES process to reflect your evolving priorities, ensuring your wealth is managed with the same care and attention you dedicate to every aspect of your life.

TAKE OUR CLARITIES EXPERIENCE QUIZ

The CLARITIES process is a strategic framework used to assist clients in aligning their financial decisions with their personal goals. The process does not guarantee financial success, growth, or protection from loss. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. References to wealth “security” and “growth” reflect aspirational client goals and are not guarantees. Tax, estate planning, and insurance strategies discussed as part of our services are for informational purposes only and do not constitute legal or tax advice. Clients should consult with their tax and legal advisers regarding their individual circumstances. Advisory recommendations are tailored to individual circumstances, and there is no assurance that any strategy will meet its intended goals or be suitable for every investor.